The pandemic, rising trade tensions between China and the West and the outbreak of war in Ukraine are prompting governments and companies worldwide to reduce vulnerabilities in essential supply chains. Buzzwords such as ‘nearshoring’ and ‘friendshoring’ have gained popularity over the last couple of years. They refer to a reorientation of trade or production closer to home (nearshoring) or to allies (friendshoring).

Latin America nearshoring opportunities

Different research suggests that in Latin America, Mexico is best placed to benefit from nearshoring or friendshoring. It shares a 3,000-kilometre border with the United States, the world's largest consumer market, and has 13 free trade agreements, encompassing 50 countries. This includes its membership in the United States-Mexico-Canada-Agreement (USMCA) and its trade agreement with the European Union, the world's largest internal market. Moreover, it is well integrated into advanced global value chains and has competitive labour costs. Currently, the hourly wages of manufacturing in Mexico are USD 2 below those in China. The IDB (2022) estimates that nearshoring in Mexico could add USD 35.3 billion annually in exports of goods.

Mexican nearshoring benefits a one-way street

Recent developments suggest that Mexico has indeed made some progress with nearshoring: exports of goods to the US have grown by 56% since the start of the trade tensions between the US and China in 2017 as US companies such as Walmart started buying goods from Mexico or opened factories in Mexico (MGA Entertainment) instead of China. Also, FDI inflows in Mexico set a new record of USD 39 billion in 2022 and remained strong in the first quarter of 2023. Some European manufacturers, especially in the automobile industry like BMW, are for instance. opening new manufacturing facilities in Mexico to benefit from lower labour costs and closer proximity to the US consumer market.

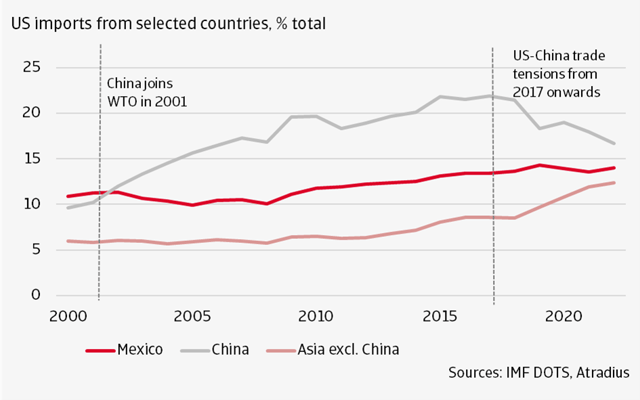

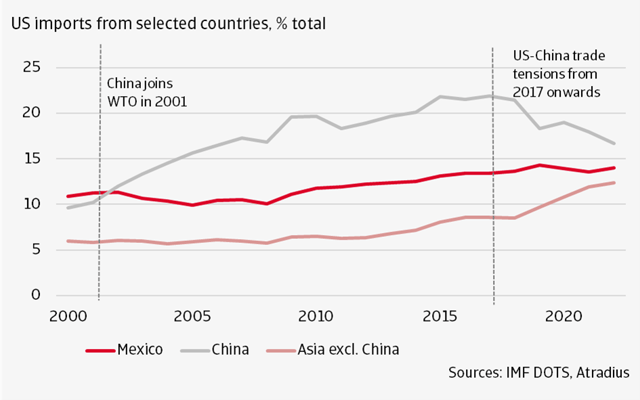

However, although Mexican exports to the US have increased, both in value and as a share of Mexican exports, Mexico's share in US imports so far has not. It is pretty stable around 14% since 2016 (see figure 1). In other words, the increased Mexican exports are the result of overall higher import demand from the US.

However, although Mexican exports to the US have increased, both in value and as a share of Mexican exports, Mexico's share in US imports so far has not. It is pretty stable around 14% since 2016 (see figure 1). In other words, the increased Mexican exports are the result of overall higher import demand from the US.

Meanwhile, the share of other Asian countries in US imports has increased from almost 9 in 2016 to over 12% in 2022. This suggests that US companies have so far been rerouting supply chains to allies in Asia, particularly Southeast Asia, instead of Mexico. The fact that 90% of the higher FDI inflows came from reinvestment from established companies, rather than new, greenfield investors, supports this. This bias is in part due to policy uncertainty in Mexico. For instance, there have been several conflicts recently between Mexico the US and Canada under the USMCA. These concern an announced reform by Mexico to the mining law, a decree that limits imports of genetically modified corn and the administration's energy policy, prioritizing the state-controlled power utility company over electricity generated by the private sector.

So far, these conflicts have not scared established investors away from Mexico, as they continue to invest in the services sector, but they have contributed to slowing manufacturing investment. This is one of the reasons why Mexico’s manufacturing sector has been stagnant since its recovery from the pandemic.

Figure 1: US opting for rerouting lost-Chinese trade with Asia instead of Mexico

Figure 1: US opting for rerouting lost-Chinese trade with Asia instead of Mexico

Recent announcements by US companies such as Phillips Industries and Tesla that they will open production plants in Mexico in 2023 and 2024 respectively might change this and lift Mexico's share in US imports. But for nearshoring to realise its potential and translate into higher economic growth, greenfield FDI and a redirection of FDI to the manufacturing sector are key. Moreover, FDI needs to be accompanied by domestic investments by the private sector into manufacturing. Public investments in infrastructure and more market-friendly policies will be needed to make this happen. As long as concerns remain about contract enforcement and the rule of law, realized gains of nearshoring will remain modest.

-1.png?width=300&name=Blogs%20%20(1)-1.png)

-1.png?width=300&name=Blogs%20%20(1)-1.png)

.png?width=300&name=Blogs%20%20(2).png)

However, although Mexican exports to the US have increased, both in value and as a share of Mexican exports, Mexico's share in US imports so far has not. It is pretty stable around 14% since 2016 (see figure 1).

However, although Mexican exports to the US have increased, both in value and as a share of Mexican exports, Mexico's share in US imports so far has not. It is pretty stable around 14% since 2016 (see figure 1).  Figure 1: US opting for rerouting lost-Chinese trade with Asia instead of Mexico

Figure 1: US opting for rerouting lost-Chinese trade with Asia instead of Mexico