.png?width=300&name=Blogs%20%20(2).png)

Can Western countries win back Middle East trade?

.png?width=56&name=Untitled%20design%20(3).png)

Economic news

The Middle East’s export growth was the highest in the world in 2022 at almost 8%. The region’s outperformance in imports was even more impressive, with growth of nearly 14%. The global economic slowdown will have an impact this year, but the Middle East’s trade growth will again be among the world’s highest in 2024, along with Asia and Africa. While these three fast-growing regions are propelling each other to greater heights as trade ties are strengthening, advanced economies are becoming increasingly disconnected from the Middle East.

Middle East focuses on growth markets

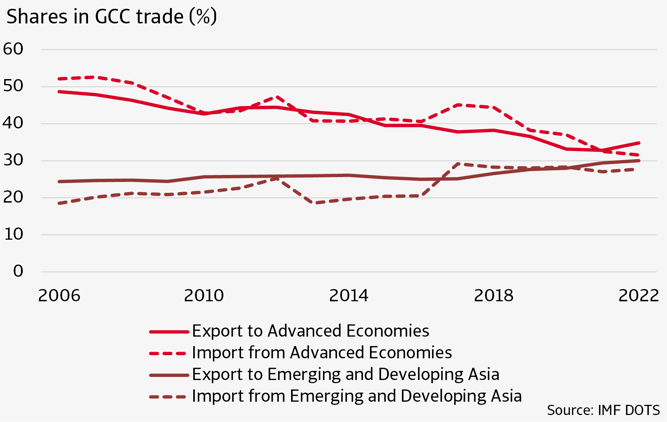

The share of Middle Eastern exports and imports to and from advanced economies has fallen from half to a third in the past fifteen years. This specifically applies to the hydrocarbon producing Gulf Cooperation Council (GCC) countries that dominate the region and include Saudi Arabia, United Arab Emirates, Oman, Bahrain, Qatar and Kuwait. At the same time, emerging Asia has strengthened its share in GCC trade by 5 to 10 percentage points and will most likely overtake the advanced economies as the GCC countries’ most important trading partner in the coming years (figure).

Figure: GCC trade with the East is overtaking trade with the West

China and India are the GCC’s main trading partners in Asia and mainly responsible for this trade shift. The growing importance of especially China as a trade partner is of course not unique to the GCC and has happened to many other countries and regions as well. It goes way back to China’s entry into the WTO in 2001 after which China became the factory of the world supplying more goods and demanding more inputs like energy. However, the fact that after all these years this still results in a growing disconnect between the GCC and advanced economies also has new reasons.

Partners wanted for fuel and non-fuel

Advanced economies are looking to phase out the use of fossil fuels and their oil demand is about to peak. The oil-related export products for which the GCC countries are best known are therefore increasingly less likely to fit within the new green standards that advanced economies are striving for. The GCC countries, in turn, have revised their trade strategies in recent years and are now more than ever focussing on deepening trade ties with countries in emerging Asia and also Africa. This fits perfectly with the two-pronged approach that the GCC countries are taking towards the energy transition. Fast-growing economies in Asia and Africa will have an unrelenting demand for fossil fuels, making them an attractive export destination for the GCC countries that are keen to be the last survivors in the declining fossil fuel market. On the import side they are suitable partners in the greening and economic diversification drive that GCC economies also have. China is already the Middle East’s main supplier of renewable energy technologies, such as solar panels, and an important source of expertise in this field. GCC imports of minerals and metals from Africa, like copper, are on the rise as they are a key material for the massive electrification of the economy that is needed for the energy transition.

Also for the import of other products and technologies, the Middle East is less and less dependent on Europe or the US. The trade deals that the UAE recently concluded with a number of partners in Asia, but also with high-tech supplier Israel, is covering a broad range of goods and also services. In striking these deals, it helps that the GCC countries’ gradual progress in export diversification offers trade opportunities in the opposite direction as well. They increasingly export non-fuel products like chemicals, manufactured goods and machinery, making them a less one-sided and hence more attractive trade partner.

Recently, the MENA region is receiving renewed attention from politicians in the US and Europe. The shift in the geopolitical balance of power due to the rise of China has reminded them of the strategic value of this region. The war between Russia and Ukraine has reinforced the need of Europe to forge closer ties with the region for energy security reasons. This explains the sudden revival in the GCC’s export share to advanced economies in 2022 (figure). Europe has largely banned Russian gas and has switched to LNG from alternative suppliers such as the Middle East. As Russia’s invasion of Ukraine and its impact on the relationship with Russia is likely to continue for some time to come, longer-term LNG deals between Europe and the Middle East are in the offing. Germany, France, the Netherlands and Italy are the first European countries to have signed long-term deals with Qatar to off-take part of Qatar’s 60% additional gas capacity that will become available when expansion works are completed between 2025 and 2027. More European countries may follow suit.

New trade corridor offers hope for Europe

The new US-backed trade corridor from India via the Middle East to Europe (IMEC), which was announced at the G20 summit in September, could help revive trade between Europe and the Middle East beyond LNG. The connecting shipping lanes, railways, and cable and (hydrogen) pipeline infrastructure this will entail can be seen as a challenge to China’s Belt and Road Initiative. While it will be difficult to compete with Asian and African countries that offer the best match regarding fuel and non-fuel trade, there is no reason for companies from advanced economies to shy away. They still have a technological advantage and there are increasing opportunities in the Middle East’s non-fuel sectors. For example, the UAE has earmarked no less than USD 163 billion for investment in the energy transition, following its landmark announcement in 2021 of its commitment to net-zero emissions by 2050. In Saudi Arabia, large contracts are awarded for the construction of the futuristic city NEOM worth USD 500 billion, which is modelled on a sustainable future. In addition to sustainable energy and construction, Western companies can also do business with the Middle East in the areas of water management and agritech.

For more information on the economic outlook of the Middle East and North Africa and the shift in trade relations towards the East and away from fuel, read our:

.png?width=66&name=Untitled%20design%20(3).png)