China’s faltering growth machine

.png?width=56&name=Untitled%20design%20(1).png)

Economic news

Ten reasons why the Chinese economy is heading for structurally lower growth.

China has developed itself into the world’s factory, with an economy that has grown fast for decades. Since 2010, however, economic growth has been slowing down. The question, therefore, arises whether China has fallen into the middle-income trap, with growth weakening too early to reach the level of prosperity of high-income countries. In an in-depth Research Note, Atradius DSB has identified ten developments that play a role in China’s growth slowdown.

1) Strict zero-Covid policy hangover

Recently, the Chinese authorities lifted many restrictions. The negative consequences of the pandemic and the strict measures will linger for quite some time.

2) Real estate sector crisis

Simultaneously with the Covid pandemic, problems in the real estate sector escalated. The government has taken measures to stabilise the housing market, but further defaults by project developers still pose a major risk to both the real estate sector itself and the financial sector.

3) High debts at local governments and state-owned enterprises

Local governments and state-owned enterprises have accumulated a large debt burden. The loans are often used for unprofitable activities and pose a threat to financial stability.

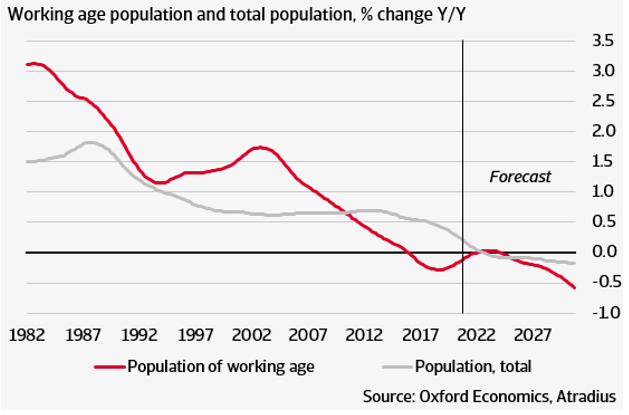

4) Ageing of China’s population

The ageing of the population has a long-term negative impact on economic growth. The main problem is that the share of the working population in the total population is decreasing rapidly. China is dealing with this at a much earlier stage of economic development than most other G20 countries.

The labour force is declining faster than the total population

5) Human capital mismatch

The Chinese working population is on average low educated. A large majority of low-skilled workers are therefore not suitable for the jobs of the future, in the advanced manufacturing industry. Another part of the working population is overeducated, which makes it difficult for graduates to find a job.

6) Low productivity growth

After impressive growth in the 2000s, productivity is barely increasing. The share of young companies in the economy has fallen, while that of old, often underperforming state-owned enterprises, remains high.

7) State control on the tech sector

Chinese regulators have taken steps in the tech sector to crack down on monopolies and abuses of market power. The measures were partly justified, but the government's tightening grip on the sector is putting the brakes on essential innovation, leading to the departure of companies from China and declining confidence among foreign investors.

8) Focus on self-reliance

In its aim to be less dependent on foreign countries, the Chinese government wants to place more emphasis on the internal market. The downside of the emphasis on self-reliance is that it comes at the expense of economic efficiency.

9) Securing global supply chains

The Covid pandemic, the war in Ukraine and the sanctions against Russia have prompted governments and companies to make supply chains less vulnerable. Especially when it comes to food, energy, technology and medical equipment, Western countries like production to take place closer to home, or in countries that are seen as more reliable. If this leads to a declining exchange of technology and knowledge, this will negatively affect China's growth potential.

10) Geopolitical rivalry

Import duties and other barriers have hit trade between the US and China hard. Last year, the trade war entered a new phase with US restrictions on the export of high-tech products to China, which will put a brake on the further development of the Chinese technology sector. The geopolitical rivalry between China and the US, and increasingly with other Western countries, is particularly detrimental to China.

Read more in the full publication: China's faltering growth engine

Questions? Ask the author: bert.burger@atradius.com.

.png?width=66&name=Untitled%20design%20(1).png)