US households built up a remarkable USD 37 trillion of wealth through the pandemic which should increase consumer resilience. The US personal savings ratio peaked at 26% in Q2 of 2020 – a staggering four times higher than one year before – as lockdown restrictions reduced supply and government transfers increased demand. This came on top of huge gains in the housing and equity markets. But the money hoarded during the pandemic is not translating into as much consumer spending as expected. As we flagged in our latest Economic Outlook, the explanation lies in who has saved more and how they intend to use it.

The savings ratio has been declining

Since private consumption amounts to about 70% of US GDP, how this money is spent is central to the US economic outlook. We see that the savings ratio has been declining as easing pandemic restrictions and health concerns drive consumers back out to shopping malls and on vacations. It’s fallen to its lowest level since the Great Recession, suggesting households are spending more of their income, but this is not reflected in incoming data. While the annual growth in personal outlays remains historically high at 8.8% y-o-y, it is quickly losing steam. Moreover, taking inflation into account, that figure falls to 2.1% y-o-y and into negative territory compared to the month before.

There are several reasons why these excess savings may not translate to the consumer resilience we would expect. For instance, the drawdown in savings may mostly be directed towards higher prices as opposed to buying more goods and services, offering fewer benefits to economic activity. More fundamentally, it could boil down to who holds this extra wealth.

Excess savings are heavily skewed towards wealthier

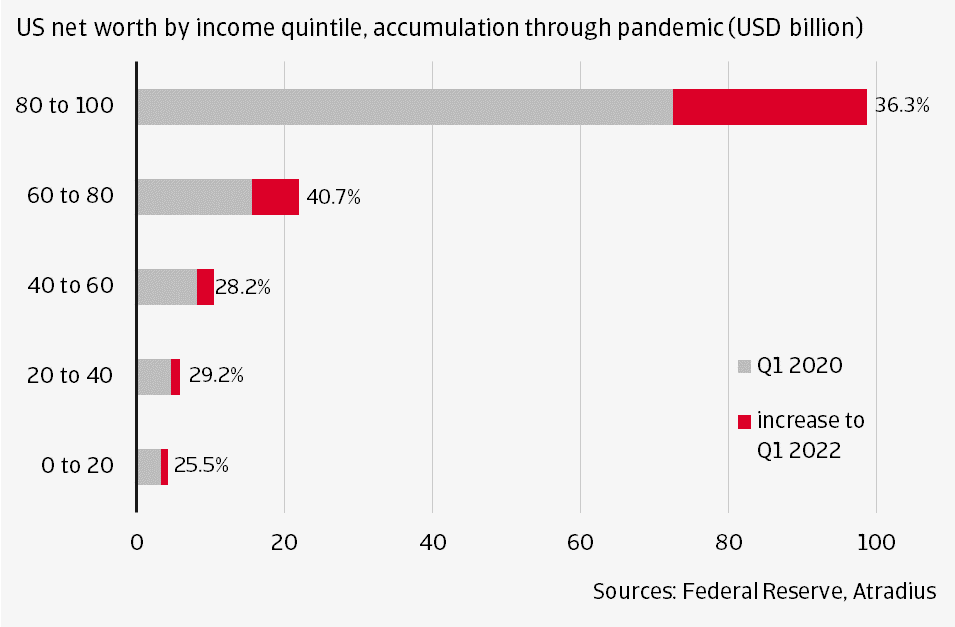

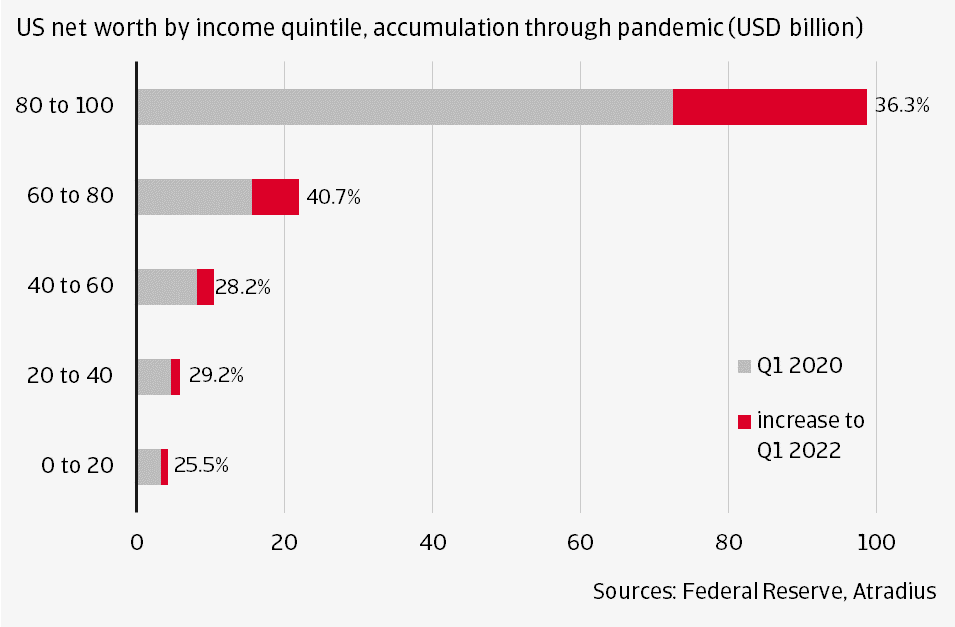

Most of the data points towards the excess savings being heavily skewed towards wealthier people – both in terms of absolute share as well as the accumulation since the pandemic. As of Q1 2022, the top quintile of households held around two-thirds of surplus savings, with the top 1% alone holding 40%. Meanwhile, the bottom quintile of households has entered a savings deficit relative to pre-pandemic saving patterns.

Graph 1 Most of the wealth gained through the pandemic is in the hands of the highest earners.

Money circulating in the economy

This does not bode well for money circulating in the economy. People with lower incomes tend to save less as more of their income is devoted to subsistence consumption while higher-income individuals save more. This is because their disposable income is sufficient to satisfy their wants and needs regardless of economic developments. As such, they generally store their wealth in less liquid assets like real estate and corporate equities. These markets surged through the pandemic, accounting for 70% of the total growth in net wealth. Today, nearly three-quarters of the total stock of these assets is in the hands of the top quintile. This means the majority of the excess savings would most likely remain just that – savings.

Avoiding recession largely relies on private consumption, which should be supported by the trillions of dollars in excess savings accumulated over the past two years. However, given the fact that most of the excess savings are held by those least likely to spend it, the path to a soft landing is getting narrower.

-1.png?width=1335&name=Blogs%20%20(1)-1.png)