The insolvency adjustment process, which was already initiated in 2022, is continuing in 2023 and 2024 according to Atradius DSB. The phasing out of fiscal support measures and the lifting of temporary changes to insolvency legislation push the insolvency level higher in most markets.

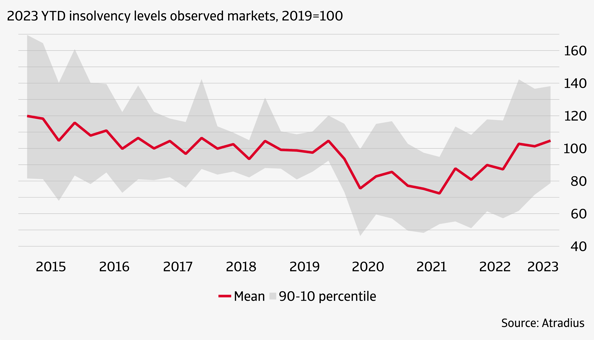

The global number of insolvencies increased by 9% in 2022. Figure 1 shows that this increase has continued in 2023, as the mean insolvency level is already above 2019. Still, the spread of the insolvency level is wide across countries (the grey area in Figure 1). Currently, 17 out of 29 observed markets have adjusted fully back to normal or are even overshooting the pre-pandemic insolvency levels. Six months ago, this was the case for 12 markets.

Figure 1: Insolvency levels compared to pre-pandemic

We already see a relatively high insolvency level in countries like Turkey, South Korea, the United Kingdom, Switzerland and Finland. A number of these countries have particular economic issues. In Turkey, for example, the economy is suffering from high inflation, depreciation of the lira and high corporate debt. In the United Kingdom, the pandemic-related government support has ended and the economic recovery since Brexit has been weak.

Outlook for 2023: higher insolvencies in almost every market

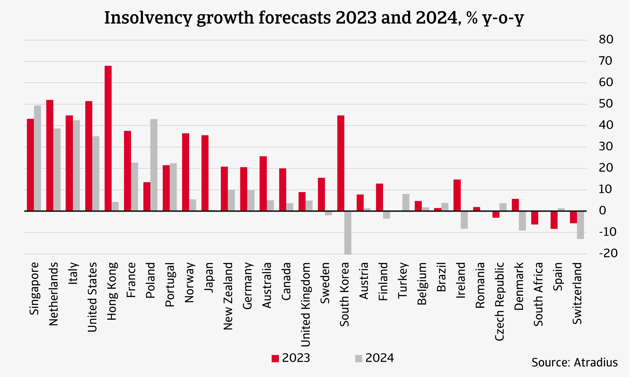

In 2023, we expect to see a high insolvency growth rate in Hong Kong, the Netherlands, the United States, South Korea and Italy (figure 2). For the Netherlands, the United States and Italy, insolvencies were relatively low at the start of 2023 and the projected insolvency growth in 2023 is mostly driven by an adjustment back to pre-pandemic levels. For South Korea and Hong Kong, the increase in insolvencies was already well underway in 2022.

Figure 2: Insolvency increases in 2023 and to a lesser extent in 2024

There are also markets with relatively low or negative insolvency growth in 2023. Countries for which we expect a decline in insolvencies in 2023 are Spain, Switzerland and the Czech Republic. In these countries, insolvencies have increased quite a bit already in 2022, in part due to the assumed bankruptcy of zombie firms. In 2023, we forecast a decline, such that the insolvency level moves closer to the normality level.

Outlook for 2024: a more mixed picture

For 2024, we are still predicting insolvency increases for the majority of markets, but the percentage increase is generally lower than in 2023. On a global level, we predict that insolvencies rise by 19% compared to 2023.

We see a substantial increase in insolvencies in a number of countries. In Singapore, Poland, Italy, the Netherlands and the United States the normalization started in late 2022 or early 2023 and we expect that this will continue well into 2024. But there will also be markets with a negative expected insolvency growth in 2024, such as South Korea, Switzerland, Denmark and Ireland. Overall, the picture is more mixed in 2024.

The coming years are likely to remain challenging for firms. Companies have emerged from the pandemic with much higher debt. The ability to service this debt is an increasing challenge in an environment with higher interest rates.

-1.png?width=56&name=Untitled%20design%20(1)-1.png)

-1.png?width=66&name=Untitled%20design%20(1)-1.png)