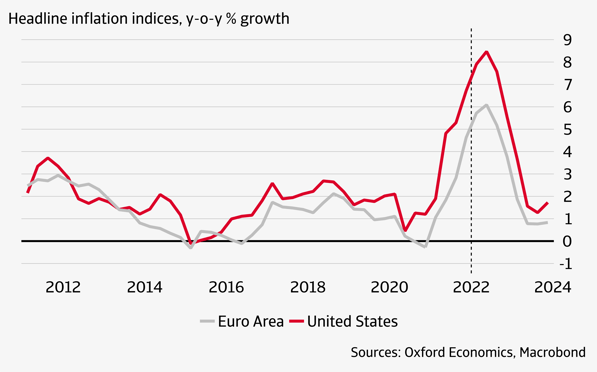

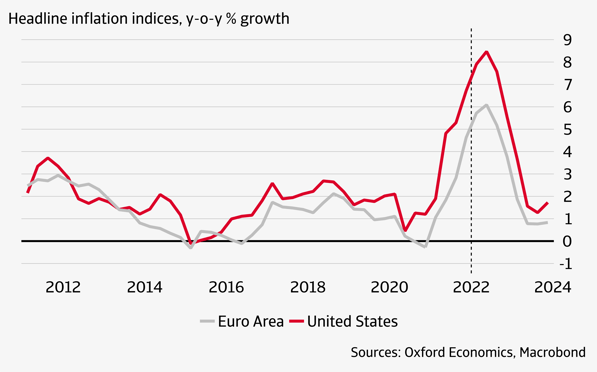

We are all feeling it in our wallets, in the supermarket, at the pump, when the energy bill hits the doormat: inflation. The US is leading the way. In March, headline inflation was at 8% y-o-y. The Eurozone was hardly behind at 7.5%. It eats into the purchasing power of the consumer, precisely the one destined to catapult global growth away from the Covid-19 drag.

To what extent should we worry that inflation will haunt us, like in the seventies and eighties when only draconic interest rate rises were able to tame the beast? In our latest Interim Economic Outlook we provide the answer. Inflation, sure, but it is not going to last. At least not in our baseline scenario where the Russian war on Ukraine is not protracted and gas supplies are not are severely disrupted.

The argument is as follows, noting that supply-side strains, energy and other commodity prices were at the heart of the current price rises. First, supply-side strains will ease, including shipping cost which is already levelling off. This is because the demand switches back towards services from goods as health restrictions ease. There is also less supply-side disruption as Covid wanes and factories no longer have to close or reduce production. Russia and Ukraine are not that important for the global supply chain to change that picture.

Second, the war has pushed up energy prices and created a lot of price volatility. But unless the gas supply is severely restricted further price rises from these already high levels rises are not expected. On the contrary, downward pressure is more likely. This story holds for other commodity prices as well.

Third, inflation as such eats into demand, which lowers price pressure. Especially purchasing power of consumers is hit. Whereas this may initially be compensated by tapping into savings from the pandemic that will not last. Monetary tightening that we currently see taking off reinforces demand reduction, especially for firms: finance will be more costly, although conditions remain relatively loose.

Fourth, the important technical ‘base’ argument is that prices are being compared with the comparable period of the previous year. Precisely in the second half of 2021 prices started to rise significantly. Further inflation will only come if price levels continue to rise, also in the second half of 2022, which is not likely.

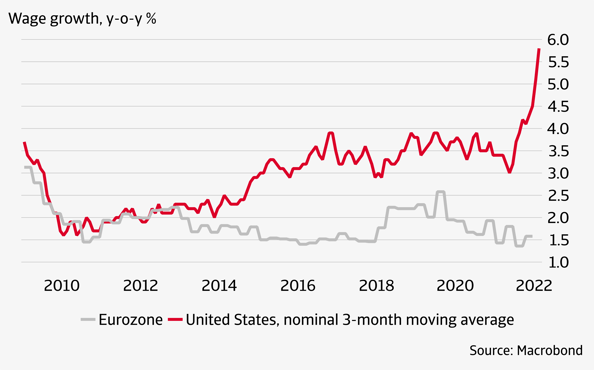

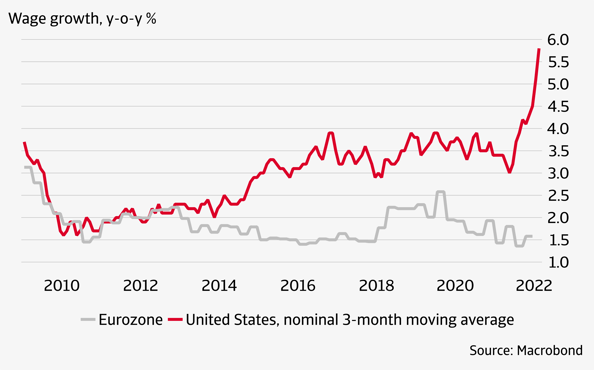

Such continuation of price rises is also not likely because wage rises remain muted, especially in the Eurozone. That prevents a vicious circle of price and wage increases to be put in motion. In this context, we should not be fooled by what is happening in the US, where we see a significant wage increase. But these are not wage increases driven by workers. Rather, it is firms that see opportunities to do business at current price levels and want to lure workers to join at higher wages. That is not set in motion a wage-price increase. Therefore, inflation is back, but not for long.

-1.png?width=1335&name=Blogs%20%20(2)-1.png)

.png?width=56&name=Untitled%20design%20(2).png)

.png?width=66&name=Untitled%20design%20(2).png)