Can European industry survive rising prices and competition?

-1.png?width=56&name=Untitled%20design%20(1)-1.png)

Economic news

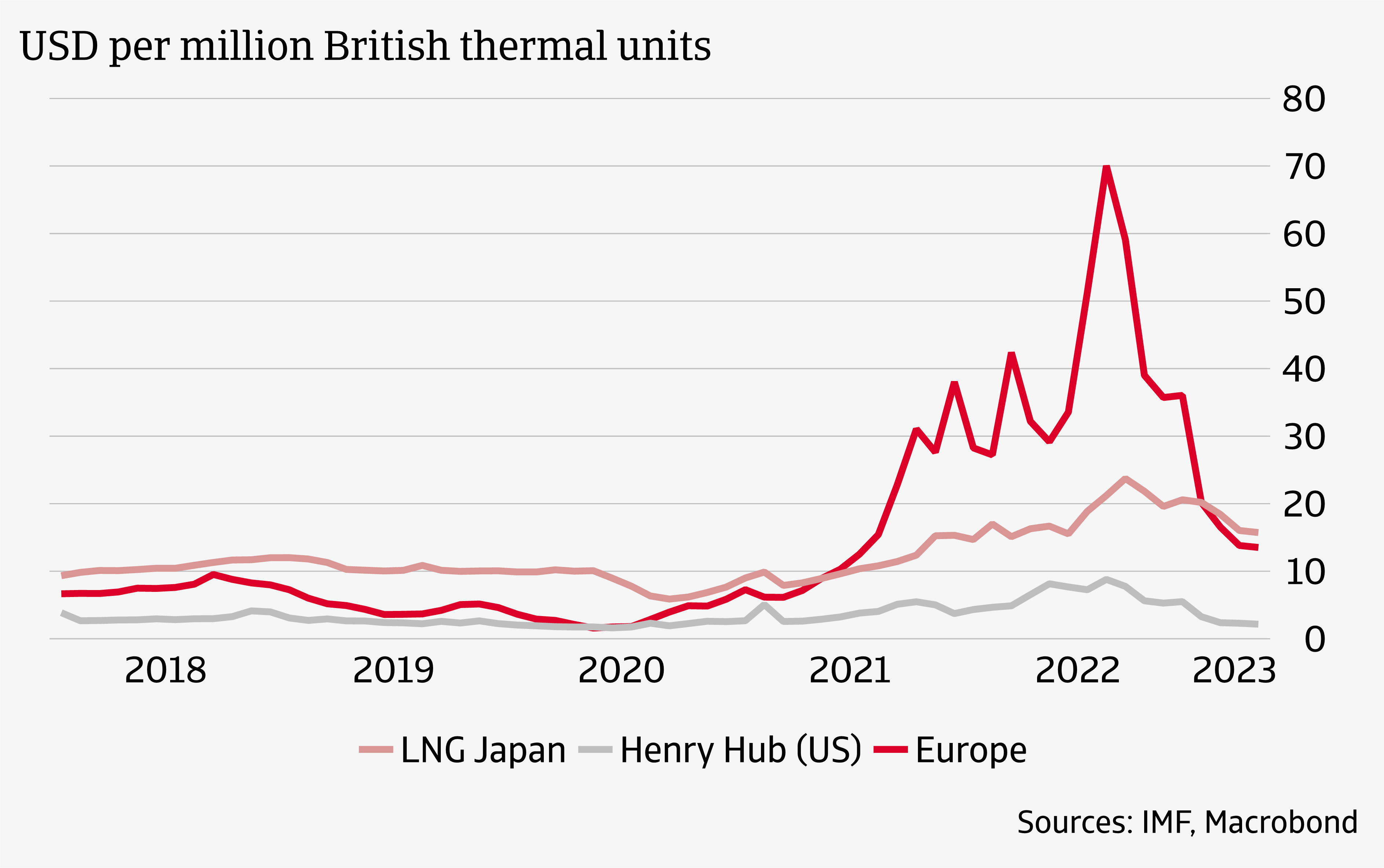

Energy markets are in a turbulent period. Russia's gas supplies to Europe have fallen by 80% since the war began. As a result, liquefied natural gas (LNG) has become the new price determinant for Europe. Because LNG is relatively expensive, and also because Europe competes with other importing regions such as Asia, this had the effect of causing the gas price to explode in 2022 (see Figure 1). In this blog, we address the question of whether this increase in energy prices poses a threat to European industry.

Figure 1: Gas price per region

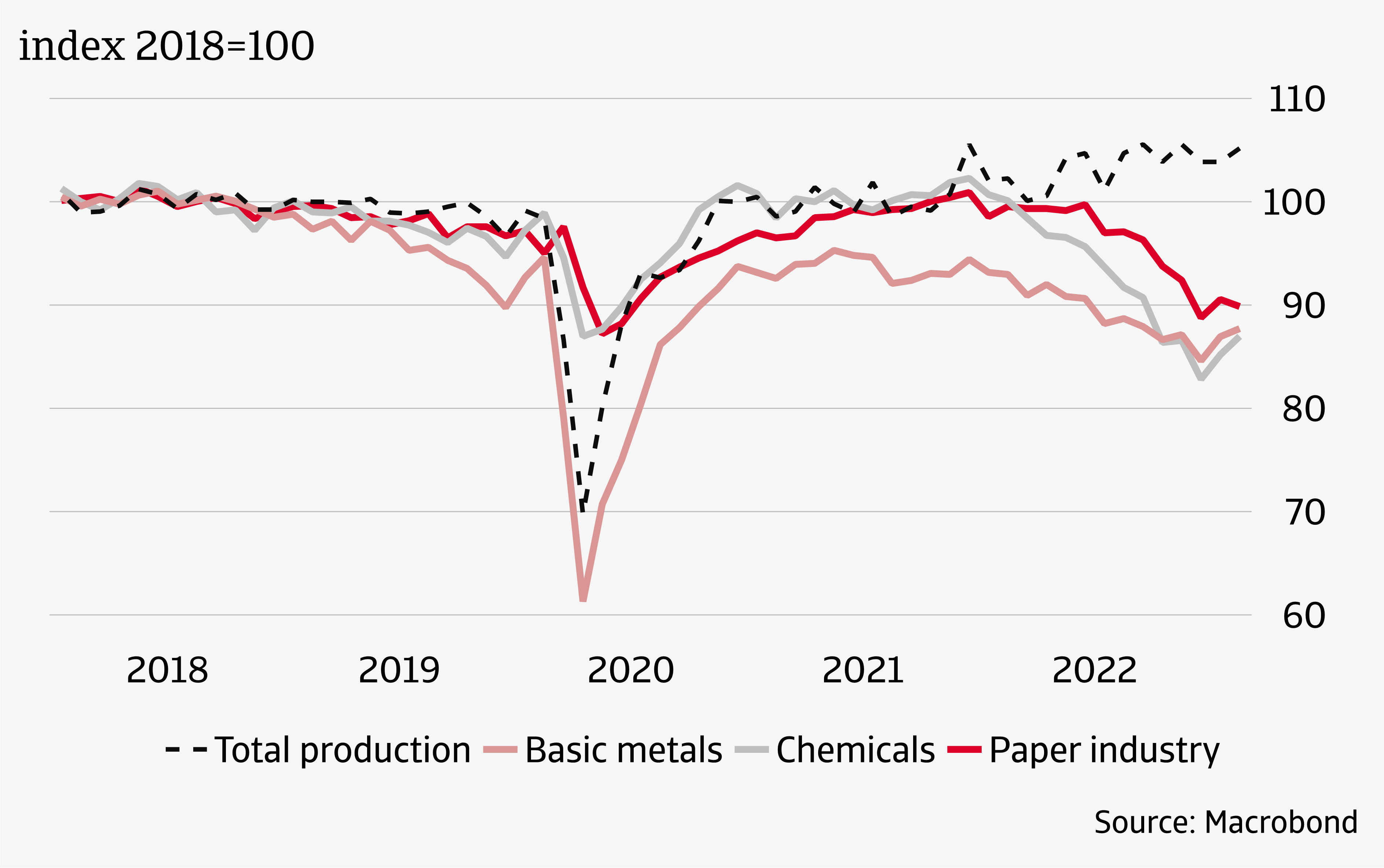

European industry is one of the largest consumers of gas. The energy crisis, therefore, hit parts of industry hard, such as the basic metal, chemical and paper industries (see figure 2). However, production in the total industrial sector remained reasonably stable, despite a 20% drop in gas usage by industrial producers. Partly by producing more efficiently, switching to other fuels and sourcing more energy-intensive inputs from outside Europe, manufacturers have been able to limit the damage to production.

Figure 2: Production of energy-intensive sectors in the eurozone

Rising energy prices are making European production more expensive in the short term. For example, the price of gas paid by European industry is three times higher than the US price. This may make it attractive for producers to move production abroad. In addition, the United States is pushing ahead with the Inflation Reduction Act (IRA). This legislation includes subsidies on the purchase of electric cars, production of cleantech products (such as batteries and solar panels) and renewable energy production. This also increases the attractiveness of the US market to European producers. For example, Volkswagen recently made news headlines when it said it was considering building a battery plant in the U.S. instead of Eastern Europe.

Will high energy prices lead to an exodus of industry from Europe? Certain industries have certainly been hit by the energy crisis, as we showed earlier. It certainly cannot be ruled out that parts of the industry will look beyond European borders. The US and Asia represent interesting alternatives. Nevertheless, we do not expect a large-scale exodus of industry from Europe. After all, large parts of the industry have been able to adapt well to rising energy prices. Compared to the peak in 2022, energy prices have now also declined significantly again.

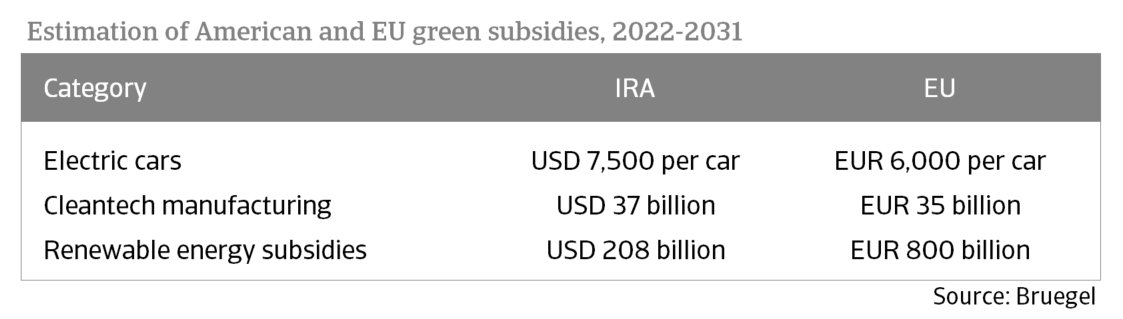

As for the danger of the Inflation Reduction Act, we can note that Europe also provides significant green subsidies. The EU has similar subsidies on the production of electric cars and cleantech goods as the US, surpassing the latter in subsidies on renewable energy (see table). However, the disadvantage of European subsidies is that they are more fragmented, as they must be applied for at the European, national and sometimes even regional levels. A relaxation of state aid rules should begin to counterbalance the IRA, according to plans from Brussels.

Figure3: American and EU green subsidies

The IRA mainly affects the European auto industry and the production of cleantech products. However, this is only part of the total industry. Moreover, manufacturers' location choices involve more factors than just subsidies. Manufacturers like to be close to their markets and also look at the institutional environment, such as regulatory stability (which may look very different again in the not-so-distant future if the White House changes party hands again next year). Therefore, we are confident that Europe’s strong geographical and institutional backdrop, supported by ongoing policy support from Brussels ensures continued growth for European industry through the energy transition.

-1.png?width=66&name=Untitled%20design%20(1)-1.png)