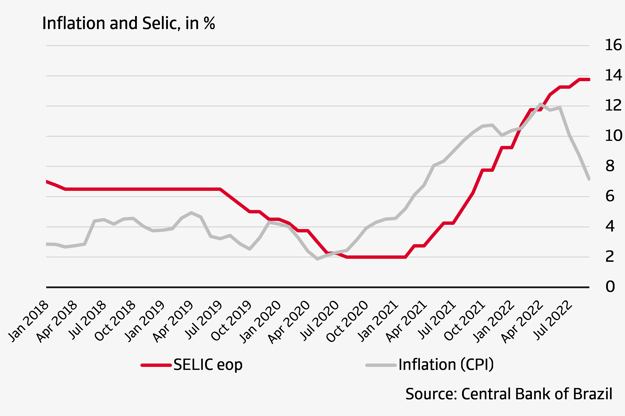

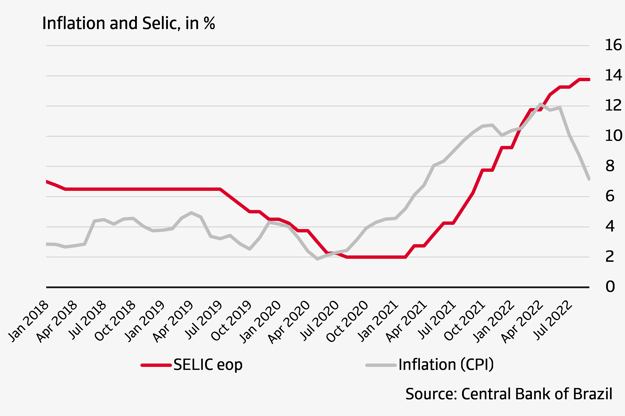

The Central Bank of Brazil kept its policy rate (the Selic) on hold at 13.75% in the first two meetings since end-September, a decision that marks the ending of the longest and steepest period of rate hiking since the central bank started its inflation-targeting regime in 1999. The earlier rate increases, from 2% in March 2021 to 13.75% last August, were necessary because of rapidly rising inflation. Inflation rose from less than 2% at the beginning of 2020 to more than 12% in April 2022. Inflationary pressures were caused by the recovery in demand after the coronavirus pandemic, the depreciation of the currency and rising prices for energy and food.

How long the Central Bank's policy break will last and what the next step will be, however, depends on the evolution of inflation expectations in the coming quarters. Brazil was one of the first countries to start tightening its monetary policy and this strategy seems to be having an effect. Consumer price inflation has been falling since July and amounted to 7.2% in September; a reduction in administrative prices and a decline in global oil prices contributed to this as well. In its base scenario, outlined in its most recent press communique of October, the central bank forecasts inflation to gradually decline to 3.2% in the second quarter of 2024, around its target. As the relevant period for monetary policy setting is six quarters ahead, this justifies the decision of the central bank to keep the policy rate on hold. Moreover, the central bank forecasts inflation to average 2.9% for the full year 2024, well within the target range of 1.5-4.5% set for that year. We thus expect interest rates to stay high for quite some time. Interest rate cuts are not likely to happen before the second half of 2023.

However, upside risks to inflation are high. Aside from the risk of greater persistence of global price pressures, the election of Lula da Silva as the new president of Brazil could usher in a period of uncertainty. It is unclear whether incumbent president Bolsonaro will accept his loss. Furthermore, it is highly uncertain whether president Lula da Silva will be able to restore confidence in Brazil’s public finances.

Graph: Higher interest rates contributed to declining inflationary pressures.

Concerns over public finances are fuelled by rising domestic interest rates – 40% of Brazil’s government debt is linked to the policy rate –, and the loss of credibility of its fiscal frameworks. This uncertainty creates exchange rate volatility and – at times – downward pressure on the currency. The greater this pressure, the larger the upward effect on inflation. The central bank, therefore, stressed that it will not hesitate to resume the tightening cycle if inflation does not ease as expected.